Bookkeeping NC III is one of the courses offered by TESDA Online Program. It is a competency-based training program that prepares learners to become efficient bookkeepers in various industries.

Also read: TESDA Bookkeeping NC III Course

In this course, students will learn how to record and summarize financial transactions, prepare different types of financial statements, and analyze financial data. They will also be trained on how to use accounting software and other computerized tools for bookkeeping tasks.

Benefits

Here are some benefits of taking the Bookkeeping NC III by TESDA Online Program:

- Develops critical thinking skills: Analyzing a firm’s internal control manual helps learners identify risks and improve systems, enhancing critical thinking.

- Enhances attention to detail: Reviewing internal controls sharpens the ability to catch errors in financial records, a key skill in bookkeeping.

- Prepares for future job opportunities: TESDA Bookkeeping NC III certification gives learners a competitive edge, as many businesses require certified bookkeepers.

- Increases employability: Certification boosts job prospects and career advancement opportunities in various industries.

- Promotes responsible financial management: Certified bookkeepers help businesses track finances accurately and make informed decisions.

- Encourages continuous learning: Certification keeps bookkeepers updated on new practices, technology, and regulations for better service.

- Demonstrates professionalism: Certification highlights a bookkeeper’s expertise and commitment, increasing their credibility with clients and employers.

- Opens up new career opportunities: Growing small businesses and startups are creating a higher demand for certified bookkeepers.

Modules

Module 1: Introduction to Bookkeeping

This module covers the key skills and knowledge needed to successfully handle the roles and responsibilities of a Bookkeeper. It includes lessons on essential workplace practices and the basics required for the job.

UNIT 1: Working in the Bookkeeping Industry

LESSON 1: Overview of Bookkeeping

LESSON 2: Collaboration and Communication in the Workplace

LESSON 3: Practicing Occupational Health and Safety Measures in the Workplace

At the end of this unit, you should be able to:

- Describe the Industry of Bookkeeping

- Apply leadership skills within the workplace

- Practice occupational health and safety measures in the workplace

UNIT 2: Fundamentals of Bookkeeping

LESSON 1: Practicing Mathematical Operations

LESSON 2: Navigating ICT Technologies

At the end of this unit, you should be able to:

- Perform basic mathematical operations

- Navigate ICT Technologies

Module 2: Journalizing Transactions

This module teaches the knowledge, skills, and mindset needed to record business transactions in an accounting journal. It includes lessons on the best practices and procedures for journalizing transactions.

UNIT 1: Preparing Charts for Journalizing Transactions

LESSON 1: Familiarizing the Generally Accepted Accounting Principles (GAAP)

LESSON 2: Preparing Charts of Accounts

At the end of this unit, you should be able to:

- Determine the components of journalizing accounting transactions.

- Prepare charts of accounts.

UNIT 2: Analyzing Documents for Journal Entry

LESSON 1: Familiarizing Journal Entry Documents

LESSON 2: Establishing the Principles of Analyzing Documents

At the end of this unit, you should be able to:

- Identify the different types of journal entry documents.

- Analyze documents for journal entry.

UNIT 3: Preparing Journal Entry

LESSON 1: Preparing Data for Journalizing Transactions

LESSON 2: Closing the Books of Account

At the end of this unit, you should be able to:

- Prepare journal entry transactions.

- Encode transaction details in the journal.

This module teaches you how to post transactions both manually and digitally. It covers the basics, including formats and procedures, to help you build a strong foundation.

Module 3: Posting Transactions

This module shows you how to record transactions manually and digitally. It explains the basics, including formats and steps, to help you develop a solid understanding.

Unit 1: Preparing Ledgers for Posting Transactions

LESSON 1: Understanding Ledger Accounts

LESSON 2: Preparing the Ledger for Posting Transactions

At the end of this unit, you should be able to:

- Identify the different ledger accounts.

- Prepare a ledger for posting transactions.

Unit 2: Posting Entries to the Ledger

LESSON 1: Posting Journal Entries to the Ledger

LESSON 2: Summarizing Entries in the Ledger Account

At the end of this unit, you should be able to:

- Post journal entries into a ledger account.

- Summarize entries in the ledger accounts.

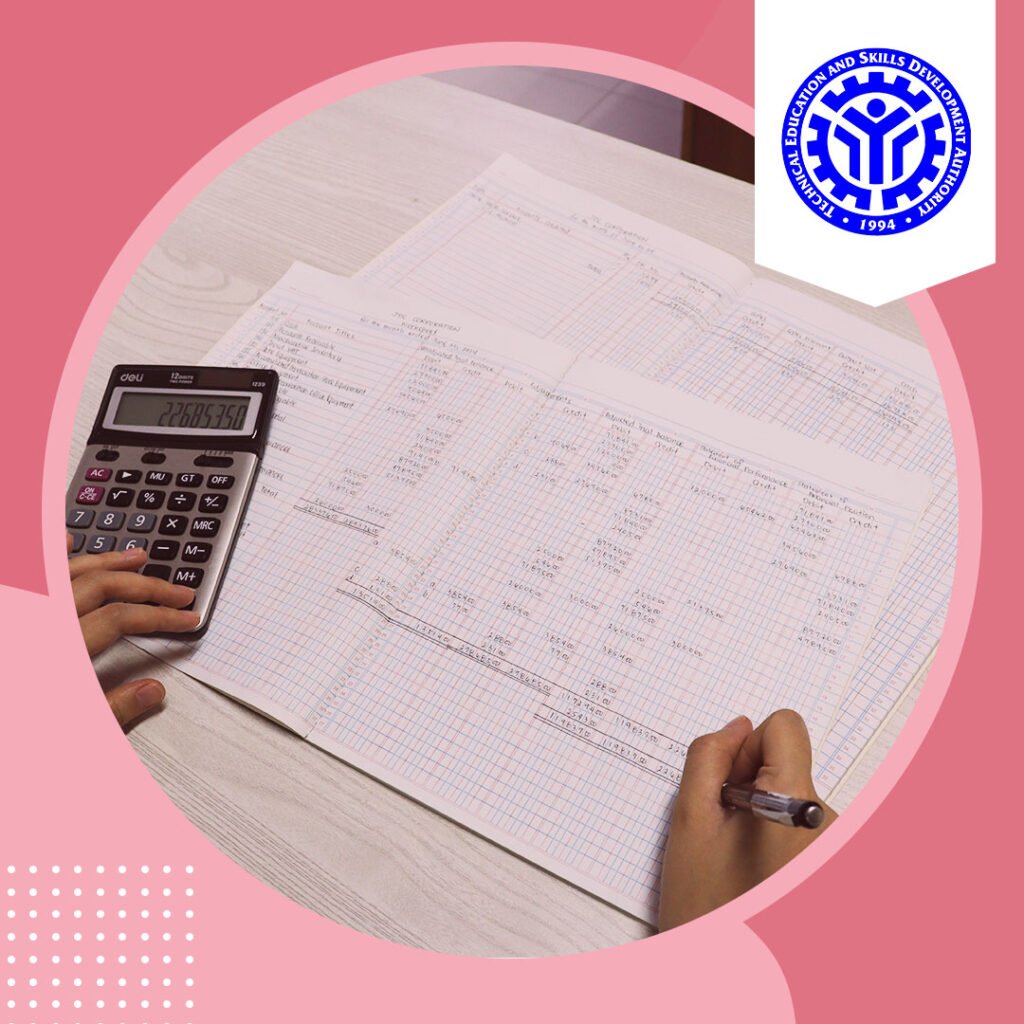

Module 4: Preparing Trial Balance

This module teaches you how to list accounts, transfer trial balances from a ledger, and summarize them. It includes lessons on key points to consider when preparing and summarizing a trial balance.

UNIT 1: Preparing the Trial Balance

LESSON 1: Determining the Components of Trial Balance

LESSON 2: Fundamental Principles in Preparing Trial Balance

At the end of this unit, you should be able to:

- Identify the characteristics of trial balancing.

- Demonstrate the fundamental principles in preparing a trial balance.

UNIT 2: Summarizing Trial Balances

LESSON 1: Preparing Trial Balances

LESSON 2: Locating and Correcting Errors in Trial Balance

At the end of this unit, you should be able to:

- Summarize three types of trial balance.

- Correct errors in trial balancing.

Module 5: Preparing Financial Reports

This module teaches you how to prepare financial reports manually. It includes lessons and topics to guide you through the process.

UNIT 1: Preparing Financial Statements

LESSON 1: Verifying Financial Data

LESSON 2: Preparing Financial Statements

At the end of this unit, you should be able to:

- Identify the components of financial data.

- Interpret the principles of financial statements.

- Prepare financial statements.

UNIT 2: Conducting Financial Analysis and Reports

LESSON 1: Analyzing Financial Statements

LESSON 2: Fundamentals of Notes to Financial Statements

At the end of this unit, you should be able to:

- Analyze financial statements.

- Conduct financial reports.

Module 6: Reviewing Internal Control System

This module teaches the knowledge, skills, and mindset needed to review and assess how well a firm follows its internal control manual. It includes lessons on evaluating its effectiveness and preparing the manual.

UNIT 1: Checking the Policy for Compliance

LESSON 1: Components of Internal Control System

LESSON 2: Fundamentals of Internal Control System

At the end of this unit, you should be able to:

- Define the internal control system.

- Identify the fundamentals of the internal control system.

UNIT 2: Preparing Policy Compliance Report

LESSON 1: Checking Internal Control Policy Compliance Report

LESSON 2: Preparing Policy Compliance Report

At the end of this unit, you should be able to:

- Check the internal control policy compliance report.

- Prepare the policy compliance report.

Sample of Certificate of Completion

Video: How to Pass the TESDA Bookkeeping NC III Assessment

If you are currently enrolled in Bookkeeping NC III by TESDA, you may be wondering about the assessment process and how to prepare for it.

In this video, you will learn everything you need to know about passing the TESDA Bookkeeping NC III assessment, including important tips and strategies for success.

Summary

The Bookkeeping NC III Online Course by TESDA Online Program equips you with essential accounting skills and hands-on experience for a successful career in bookkeeping. With a TESDA certificate, you’ll gain a competitive edge in the job market, whether starting your own business or working for a company. Enroll today and take the first step toward becoming a certified bookkeeper!