TESDA offers Lifelong Learning Skills Online Courses that offers also a convenient and accessible way for individuals to enhance their knowledge and skills. Whether it’s improving financial literacy or preparing for career success, these courses are designed to empower learners with practical tools for personal and professional growth. With self-paced, interactive modules available through the TESDA Online Program, anyone can upskill at their own convenience, making learning flexible and attainable for all.

Also read: Full List of Courses under TESDA Online Program

Among the offerings are courses like Personal Financial Management, which covers essential topics such as budgeting, saving, and debt management, and the Skills to Succeed Academy, developed in partnership with Accenture. These programs provide valuable insights for navigating financial independence and preparing for competitive job markets. By combining advanced learning technologies with real-world scenarios, TESDA online courses equip individuals with the skills they need to succeed in life and work.

Benefits

Here are some benefits of taking the Lifelong Learning Skills Online Course by TOP:

- Convenient and Flexible Learning: TESDA online courses allow you to study at your own pace, anytime and anywhere, making it ideal for busy individuals balancing work or personal responsibilities.

- Career Advancement: The Skills to Succeed Academy helps enhance your skill set with interactive modules, increasing your competitiveness in the job market.

- Improved Financial Literacy: Courses on financial management teach essential skills like budgeting, saving, and debt management, helping you achieve financial independence.

- Interactive and Engaging Content: Advanced learning technologies, relatable scenarios, and exercises make learning practical and engaging.

- Cost-Effective: Access to these courses is free through the TESDA Online Program, making skill development accessible to everyone.

- Applicable Life Skills: Gain knowledge that directly impacts your personal and professional life, from financial planning to navigating career challenges.

- Self-Development: Build confidence by mastering skills that empower you to manage your finances and succeed in your career.

Personal Financial Management Courses

Take control of your finances with the Personal Financial Management Courses offered by the TESDA Online Program. These free, self-paced courses cover essential topics like financial planning, budgeting & saving, and debt management to help you build a secure financial future. Learn practical skills and strategies to manage your money effectively and achieve your financial goals today.

Financial Planning

The Financial Planning module introduces the basics of personal money management. Participants will learn to use tools like budget plans and financial calculators to manage resources effectively. It covers the financial planning cycle and emphasizes the importance of planning for long-term stability. By the end, learners will gain the knowledge and skills to take charge of their financial future.

This eLearning module on Financial Planning is the first in a nine-part Financial Literacy series created with Bangko Sentral ng Pilipinas, TESDA, and BDO Foundation.

After completing this module, you will be able to:

- Define the basic concepts of financial planning

- Explain the importance of financial planning

- Utilize common financial planning tools.

This is a self-paced module. Begin your journey by answering the Pre-test, which will grant you access to all the lessons and activities in the course. Complete all the unit tests and the post-test to receive your certificate.

Budgeting and Saving

This module helps learners understand the importance of budgeting and saving for financial stability. It covers practical tips for creating and managing budgets, introduces saving formulas, and explains different savings products. By the end, participants will be equipped to make smarter financial decisions.

The Budgeting and Saving module is part of a nine-course Financial Literacy series created with the Bangko Sentral ng Pilipinas, TESDA, and BDO Foundation.

After completing this module, you will be able to:

- Articulate the importance of saving and budgeting in financial planning

- Apply good practices in saving and budgeting your personal finances

This is a self-paced module. Begin your journey by answering the Pre-test, which will grant you access to all the lessons and activities in the course. Complete all the unit tests and the post-test to receive your certificate.

Debt Management

The Debt Management module provides a basic understanding of debt and its impact on personal finances. Learn to identify good vs. bad debt, assess your borrowing capacity, and explore the rights and responsibilities of lenders and borrowers. By the end, you’ll be equipped to manage debt responsibly and make informed financial decisions.

This eLearning module on Debt Management is the third in a nine-part Financial Literacy series, developed with Bangko Sentral ng Pilipinas, TESDA, and BDO Foundation.

After completing this module, you will be able to:

- Differentiate good and bad debt

- Apply checklist to consider before borrowing

- Explain the rights and responsibilities of lenders and borrowers

This is a self-paced module. Begin your journey by answering the Pre-test, which will grant you access to all the lessons and activities in the course. Complete all the unit tests and the post-test to receive your certificate.

Skills to Succeed Academy

The Skills to Succeed Academy, developed in partnership with Accenture, offers self-paced, interactive modules designed to help you choose the right career, find a job, and grow in your chosen field. Through relatable characters, advanced learning technology, and hands-on exercises, you’ll learn by doing with ongoing support. You can revisit or redo the training anytime, making it a flexible and practical resource for career development.

Learning Outcomes

- The Academy equips you with essential skills to choose the right career path, secure a job, and continue advancing in your chosen field.

- It offers a hands-on learning experience, allowing you to practice and experiment with ongoing support. Plus, you can return anytime to revisit or repeat the training.

Instruction

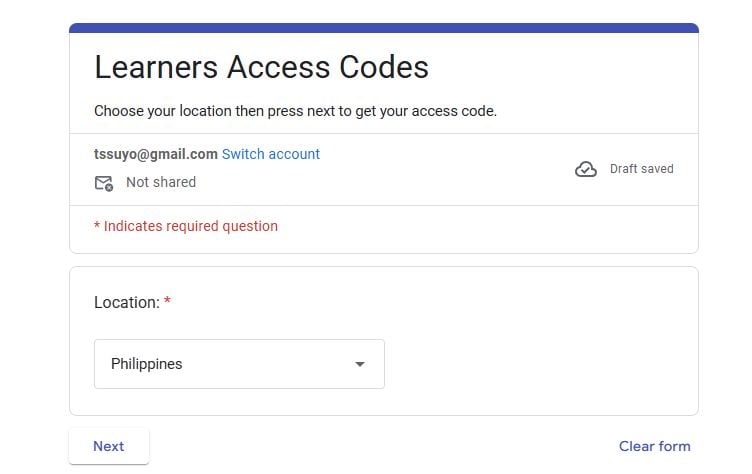

Ready to get started? Follow the steps below to access the Skills to Succeed Academy Philippines:

- Click the link to go to the Skills to Succeed Academy Philippines.

- Select the Learner Registration link to begin.

- Fill in all required details, including your email address, password, location, and more.

- Enter the Access Code specific to your location.

- Click the Submit button to complete your registration.

Managing Your Personal Finances

This course is available until May 15, 2025. Access the Financial Literacy course under Personal Financial Management.

“Managing Your Personal Finances” teaches how to make better financial decisions, improve income and spending habits, save money, and manage debts effectively.

This self-paced course was developed in partnership with Consuelo Foundation.

Financial Literacy

Learn how to become financially independent with this module. Transition from relying on your parents to managing your own income and expenses confidently. This guide will teach you how to make smart financial decisions, improve spending habits, save effectively, live within your means, and get out of debt. The goal: to fully support your housing, food, and other living expenses on your own.

Units Covered

There are 8 units covered in the course, each designed to help you understand and manage your personal finances:

Unit 1: The Road Towards Financial Independence

Unit 2: Smart Spending

Unit 3: Savings and Investing

Unit 4: Setting Financial Goals

Unit 5: Managing Debts

Unit 6: Getting a Job

Unit 7: Making Your Spending Plan

Unit 8: Marriage and Children

Note: TESDA is improving the Training for Work Scholarship Program by adding pre and post tests. Completing these tests is mandatory to receive a Certificate of Completion, ensuring program excellence.

Summary

The Lifelong Learning Skills Online Courses by TESDA Online Program provides practical lessons on managing personal finances, covering budgeting, saving, and planning for life events like marriage or having children. It also introduces investment basics, including stocks, mutual funds, and real estate, to help you make informed financial decisions. With easy-to-follow modules and complementary courses on business and entrepreneurship, this program equips you with skills to achieve financial stability and personal growth.